The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

8 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

Table of ContentsMileagewise - Reconstructing Mileage Logs - The FactsMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedIndicators on Mileagewise - Reconstructing Mileage Logs You Need To KnowSome Known Facts About Mileagewise - Reconstructing Mileage Logs.Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

The NSA. Facebook. Large Brother. People living in the 21st century deal with an unprecedented understanding of means they can be checked by powerful organizations. Nobody wants their manager contributed to that list. Or do they? An independent survey performed by TSheets in 2016 found that just 5% of employees who had been tracked by employers using a GPS system had an adverse experience.(https://www.metal-archives.com/users/mi1eagewise)In 2019, mBurse surveyed mobile employees regarding GPS monitoring and located that 81% would support their company tracking their company mileage if it suggested getting full compensation of lorry costs. In general, while some staff members reveal concerns concerning micromanagement and being tracked after hours, those that have been tracked locate those issues greatly reduced.

In order to recognize the advantages of GPS gas mileage logs without driving workers out the door, it's vital to select an appropriate GPS application and institute guidelines for proper use. Motorists should be able to modify journeys and designate specific portions as individual to make sure that no data concerning these journeys will certainly be sent to the company.

The 8-Second Trick For Mileagewise - Reconstructing Mileage Logs

Vehicle drivers ought to likewise be able to transform off the application if necessary. Even if you have data on your employees' whereabouts throughout organization travel doesn't mean you have to have a conversation concerning every detail - mile tracker app. The primary purpose of the GPS app is to offer precise mileage tracking for repayment and tax obligation objectives

It is common for most organizations to monitor staff members' usage of the net on firm gadgets. The basic truth of keeping an eye on dissuades unproductive internet usage without any type of micromanagement.

There's no rejecting there are numerous advantages to tracking gas mileage for company. Unless you're tracking gas mileage for payment objectives, functioning out how to track gas mileage for work trips might not feel like a critical job.

Getting The Mileagewise - Reconstructing Mileage Logs To Work

The charm of digital monitoring is that everything is tape-recorded. In enhancement to optimizing your tax reductions by offering trip information and timestamps with determine precision, you can remove detours and unapproved personal trips to improve worker liability and performance. Looking for a detailed remedy to aid handle your service expenditures? We can aid! At Roll, we recognize that remaining on top of management jobs can be difficult.

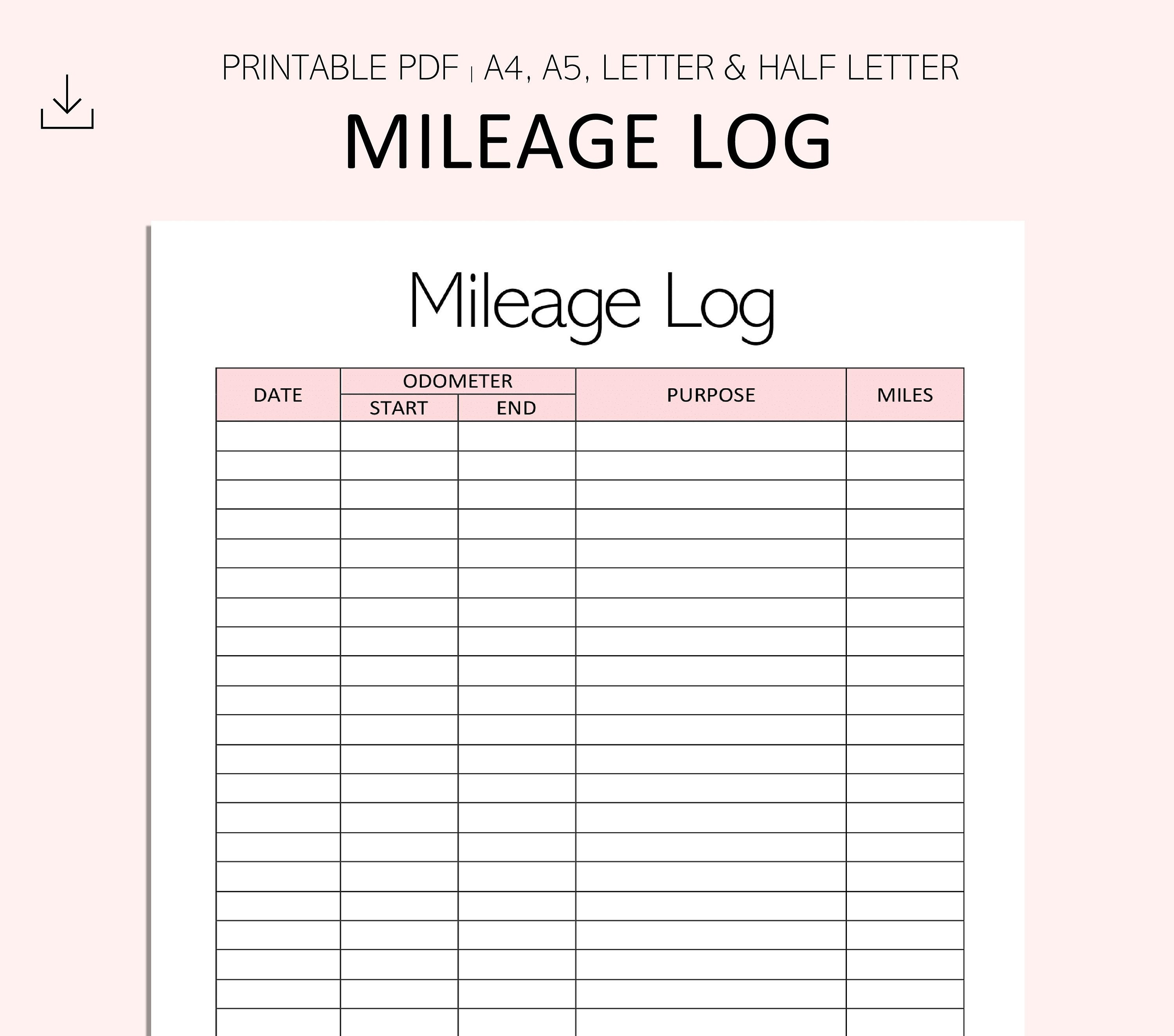

Have you experienced the pain of reviewing business journeys thoroughly? The total miles you drove, the gas costs with n variety of other expenses., repeatedly. Typically, it takes almost 20 hours annually for a single individual to visit their mile logs and other expenses.

Mileagewise - Reconstructing Mileage Logs for Dummies

Now comes the primary image, tax obligation deduction with gas mileage tracker is the broach the field. Declaring a tax obligation reduction for business has never ever been less complicated than now. All you need to do is pick between the methods that pay you extra. In detail below, we have actually clarified the two means by which you can claim tax- reduction for the organization miles travelled.

For your comfort, we have actually come up with the list of criteria to be considered while choosing the right mileage monitoring application. Automation being an important element in any service, ensure to choose one that has actually automated kinds which can determine costs rapidly. Always look for added functions provided, such as the amount of time one has functioned as in the current applications.

What Does Mileagewise - Reconstructing Mileage Logs Do?

The information is always available to you on your mobile phone to review, modify and modify at any moment. These applications are user-friendly and very easy to use. They assist you conserve time by calculating your gas mileage and maintaining a record of your data. Hence, Mileage tracker apps like Merely Auto assistance not just maintaining the mile logs however also with the reimbursement of organization miles.

Everything about Mileagewise - Reconstructing Mileage Logs

government company liable for the collection of tax obligations and enforcement of tax obligation regulations. Developed in 1862 by President Abraham Lincoln, the agency governs for the USA Department of the Treasury, with its primary purpose consisting of the collection of specific earnings taxes and work tax obligations.

Apple iOS: 4.8/ Google Play: 3.5 Stride is a totally free mileage and expense-tracking application that collaborates with Stride's various other services, like medical insurance and tax-prep aid. In enhancement to providing sites to Stride's various other items, it provides a gas mileage and expense-tracking function. I had the ability to download and mount the app conveniently and find more information promptly with both my iPhone and a Galaxy Android tablet.

While the premium application provides to connect to your bank or credit accounts to streamline expensing, it will not link to your Uber/Lyft accounts. My (restricted) testing of Everlance showed really similar gas mileages to Google Maps, so accuracy must be on the same level with the remainder of the apps. mileage tracker. Generally, I assumed Everlance was well-executed and easy to utilize, but the features of the complimentary and even exceptional versions just didn't gauge up to some of the various other applications'